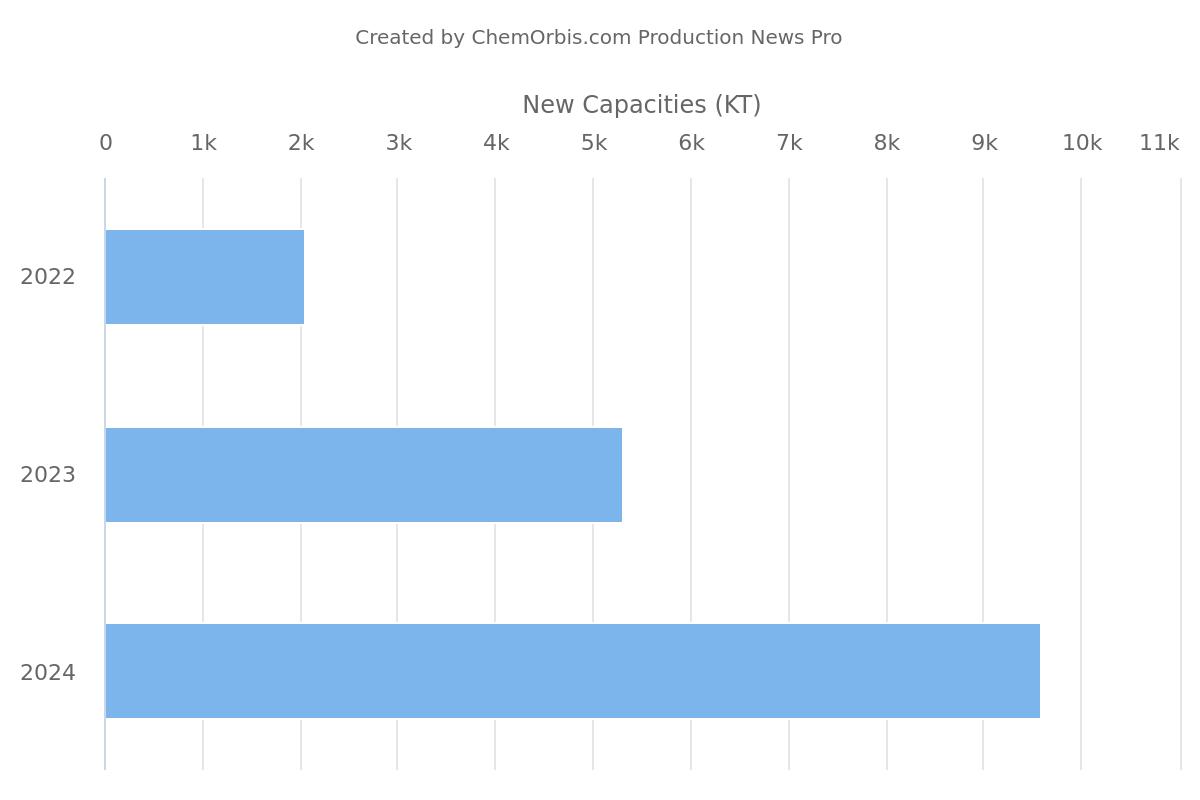

According to the latest update from ChemOrbis Pro Manufacturing News, China’s polyolefin sector is preparing for an incredible amount of capacity additions. Data shows that a large amount of polyolefin capacity is postponed from December 2022 to the first quarter of 2023, raising expectations of increased competition for market share among manufacturers and subsequent lower price.

A series of new PP, PE capacity will come into operation from January to April

Several PP and PE manufacturing plants – mainly located in coastal cities across the eastern and southern provinces – are expected to come online during the first quarter, after a short delay compared to the previous quarter. with the original plan at the end of the year.

In the PP market, about 2.6 million tons of capacity was scheduled to come online in December and this was postponed to the first quarter. Total PP capacity scheduled to launch in the first quarter now stands at more than 4.5 million tons/year, representing nearly 40% of the total additional PP capacity expected for the whole of 2023 in China.

For PE, nearly 2.5 million tons/year of new capacity has been postponed to the first quarter of 2023. This represents nearly half of the total capacity expected to come online this year.

The chart on the left shows almost 12 million tons of additional PP capacity, while the chart on the right shows 5 million tons of new PE capacity for 2023.

You can visit ChemOrbis Pro Manufacturing News to see monthly changes in new capacity as well as daily changes in globally discontinued capacity by country and product.

Domestic inventories decrease but downside risks still exist

Total PE and PP inventories of the two major domestic producers in China stood at 510,000 tonnes as of December 30. These levels were nearly 9% lower than a week earlier and also lower year-on-year. last. However, as Chinese demand is expected to decline in the days leading up to the Lunar New Year, the threat of oversupply from new factories continues into the first quarter of 2023.

Manufacturers will likely continue to cut operating capacity

Chinese manufacturers have been reducing their factory operating capacity almost since the second quarter of 2022, aiming to balance domestic supply with falling demand while minimizing pressure from production costs. higher. The majority of market participants expect PP and PE producers to continue to maintain low operating capacity throughout the first quarter to help offset the impact of the upcoming plant start-up on prices.

Click to read the full forecast for the first quarter of this year in the PP market as well as in the PE market.

For a detailed look at how uncertainty related to new mills will unfold and their impact on PP and PE prices in the coming months, check out ChemOrbis’ Price Forecast Report, which includes includes all the information you need to understand the market situation. Click the image below to get a sample report.