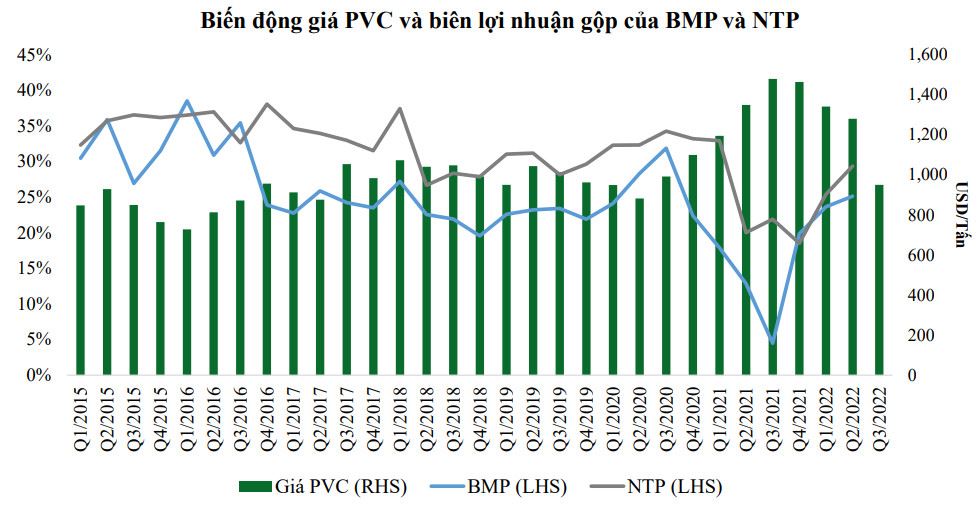

VCBS believes that in the third quarter, business results of some businesses such as Binh Minh Plastics and Tien Phong Plastics will grow well thanks to lower input prices and the prospect of the construction industry.

Vietcombank Securities Company Limited (VCBS) said that currently, Vietnam has not mastered the plastic production value chain, so imported PVC resins account for 70% of COGS and affect the profit margin of the company. enterprise.

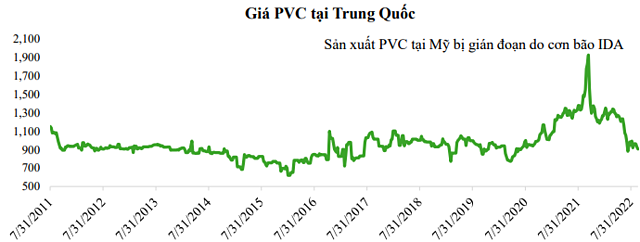

VCBS believes that PVC prices in the second half of 2022 and in 2023 will remain at a low price level in the range of $800-1,000/ton.

(Nguồn: VCBS)

The reason is that the source in the US has recovered after a long time of shortage. At the same time, the world supply increased sharply due to the expansion plans of large enterprises. Large manufacturers in India, the US and China invest in expanding PVC production as soon as 2022. From now to 2026, PVC capacity can increase by 17% to 70 million tons/year.

Besides, China accounts for 50% of PVC production and consumption worldwide. PVC demand has declined in China due to a sluggish real estate market, of which PVC demand for construction in this country accounted for 62%. China’s PVC demand may stay low until the end of 2023.

VCBS believes that in the third quarter of 2022, the business results of some businesses such as Binh Minh Plastic and Tien Phong Plastic will grow well compared to the low base level of 2021 thanks to the prospect of the construction industry.

Currently, the number of real estate apartments deployed in the North shows good growth after a long period of decline, which helps boost plastic pipe consumption in this region in the second half of 2022 and 2023. Meanwhile, the number of newly developed and new apartments in the South region shows less positive numbers, which may put pressure on consumption volume in the coming time.

However, in the long term, consumption still has potential for growth as the urbanization rate remains low. At the same time, it is expected that legal issues on real estate projects will be resolved in 2023, boosting the supply of real estate in 2024.

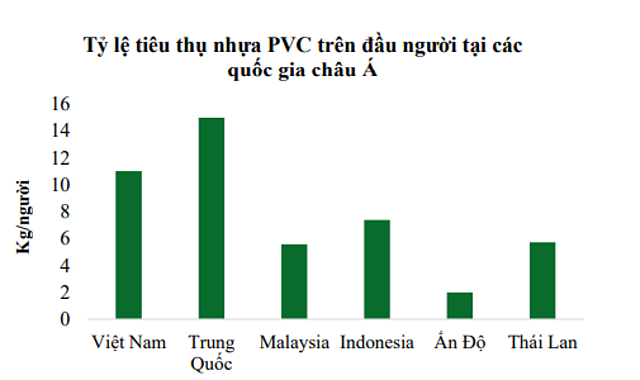

VCBS estimates that PVC consumption growth will grow at 7-10% in the coming period, much lower than 15-20% in the 2014-2017 period due to the per capita consumption rate in developing countries. Asian countries at a high level.

Theo VPAS